VCapital looks for entrepreneurs who innovate for the long game, the ones who can withstand the inevitable challenges of change and disruption, especially when the world feels the most turned upside down.

Just when we were beginning to take off our masks and head back to the office in the waning days of the global pandemic, a major war broke out in Europe. International supply chains and monetary systems seem to be coming unglued while inflation, stagnation, recession, and who knows what else is knocking at the door.

Learning from Crisis

As reported in The Daily Beast, Mellody Hobson commented that predicting the next recession or stock market crash is tough, so many of the best investors don’t even try. Instead, investors should look for good companies with the strength to make it through challenging environments. Further pondering on Winston Churchill’s famous quote, “never let a good crisis go to waste,” we ask ourselves what we, at VCapital, are learning amid a global pandemic and European war? Indeed, noise and turbulence from a crisis can turn the world upside down. However, we continue to explore, as we always have, noting what is changeable or not changeable and continuing to focus on what is timeless.

Investing in Timeless

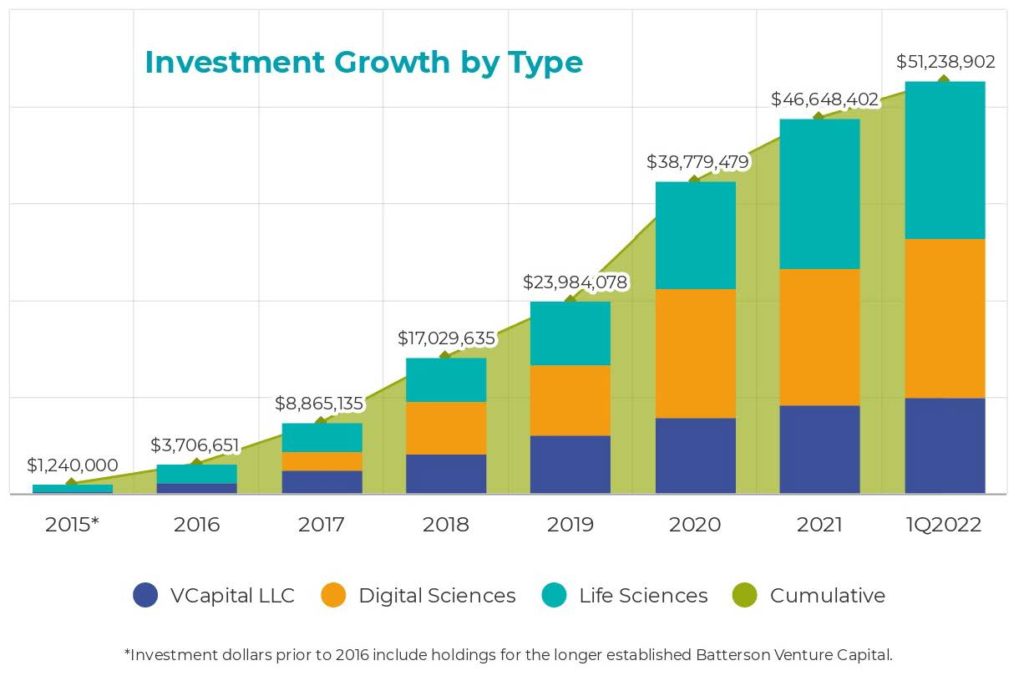

It has been six years since VCapital and its investors made their first investment in Intensity Therapeutics, supporting its focus on developing a new way to cure cancer. Pandemics and war do not stop cancer. Since then, we have identified an additional 13 companies to support with capital raises across 26 rounds. Instead of reacting to current events, we follow a process of shining a light on investment theses and impact. Is there a real problem to be solved?

While the nomenclature surrounding industries and sectors varies, the companies that we seek have the most long-game potential by:

| Solving human problems of health, quality, and longevity through life science and technology | Expanding on the newest “new normal” of information access, connectedness, and space exploration using digital science and technology |

Preparing for Exits

“Investing should be more like watching paint dry or watching grass grow. The work involved requires planning and patience. However, the gains you see over time are indeed exciting.”

Paul Samuelson, Nobel Prize winner in Economic Sciences

The typical length of time for a company to exit ranges from four to eleven years. We believe our VCapital portfolio is in the middle of the game. Not all companies will be winners, but some of ours will be in a few years. Our unique model allows for investing directly in single deals when open, in the full VCapital portfolio anytime, or combining both options for additional diversification. New investors can take advantage of older investments within VCapital LLC and benefit from potential winners after they have closed for direct investment.

The partnership of the VCapital team, our portfolio companies, and our co-investing partners are forward-looking within the niches that withstand inevitable ongoing change and disruptions.

Continually investing in the future, never quitting even when under siege, is always the smartest move. We look forward to hearing from you with feedback, questions, or interest at any time.

Other articles you might like

About Fred Tucker

Leader, Inventor, Investor, Mentor, Friend

Aging is the Mother of All Diseases.

The co-founders of Rejuvenate Bio are developing gene therapies to treat age-related diseases in human and animal health.

Venture Capital Investing Cycles

There are signs of the beginning of a new upswing in the VC investing cycle.