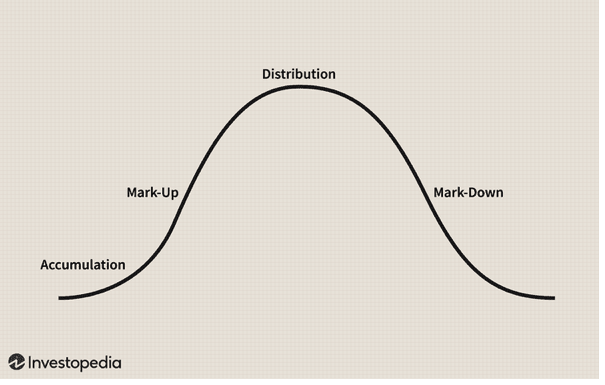

There are a variety of terms for the typical four economic cycles that markets move in. If you have lived long enough, you’ve seen several iterations.

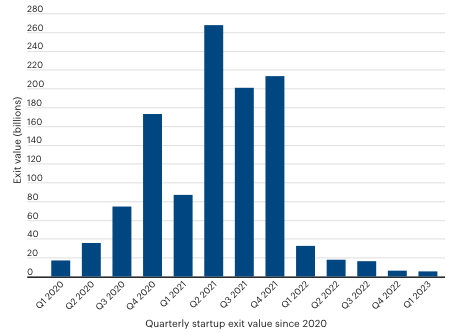

The first quarter of 2023 recorded $5.8B in exits, less than 1% of the record exit value generated in 2021, largely a result of a downturn in the general economy. Then in March, the collapse of Silicon Valley Bank wreaked havoc on venture capital and across the entire ecosystem. Even if we largely avoided the worst-case outcomes, the chaos has made it more difficult for companies to raise capital.

What does all this mean for the venture capital investor today?

There are a variety of terms for the typical four economic cycles that markets move in. If you have lived long enough, you’ve seen several iterations. Still, it’s easy to get sucked in each time a new phase comes around. It’s nearly impossible to pick the top or bottom of the cycles of accumulation, mark-up, distribution, and mark-down. Accepting the existence of cycles is essential to maximize returns, and investors who recognize the different parts of a market cycle are more able to take advantage of them.

As is often the case following a mark-down phase, a buyer’s market emerges with attractive entry pricing and an opportunity to deploy “dry powder” on the right deals with a realistic price embedded from the outset. The longer-term view and sticking to the fundamentals are much more likely to result in positive exits during a cycle with favorable market conditions.

VC investing can be described as requiring patience. Fund managers must have the experience to identify fundamentally sound businesses with proper valuations while remaining true to their investment thesis. Venture capital has been very attractive in recent years because that is where the winners of the future are found. Including investments with high-potential returns continues to have a healthy place in a diversified investment portfolio.

What does all this mean for VCapital investors?

While the industry is currently challenged, the management team at VCapital finds themselves in a strong position. We are staying true to our investment thesis, and that will not change. Our fundamentals are:

- Get in early. Early-stage continues to be an opportunity to invest when valuations are low, and return potential is greatest.

- Perform deep research. Rigorous deal screening and due diligence are never optional.

- Focus on REAL problems. Tech and science-related deals that solve “real” problems are primary and provide the greatest growth potential.

- Play bigger. A solid network to expand our reach through a consortium of co-investing firms provides access to high-quality deal flow and sharing due diligence.

- Provide mentorship. Where there is a need, our experienced team offers our portfolio companies added value during the development phases. Examples include participation in a company’s advisory board or making connections with individuals within our network with specific needed expertise.

- Stay lean and responsible. We manage our expenses with a lean team and efficient, transparent operations. We maintain multiple bank accounts to hold funds raised for portfolio companies for short periods of time. Remittances of funds to portfolio companies are made in multiple tranches to minimize exposure of holding funds over the FDIC limits.

Current Status

We have invested at favorable valuations with eight companies that are performing well and in the execution stages of their development. With several follow-on rounds opening, investing or, re-investing at lower valuations in solid, high-performing companies are more likely to achieve higher gains upon exit. In addition, these investments will likely exit during a market cycle that will provide greater profits.

We believe in entrepreneurs. Venture capital is not going away. The cream will rise to the top. However, investors expect to see a clear path to profitability and are, and should be, more discerning now than ever.

Our doors are open, and we look forward to hearing from you.

Other articles you might like

Aging is the Mother of All Diseases.

The co-founders of Rejuvenate Bio are developing gene therapies to treat age-related diseases in human and animal health.

Venture Capital Investing Cycles

There are signs of the beginning of a new upswing in the VC investing cycle.

What's in Store for 2024?

Investors have a renewed focus on portfolio construction, prioritizing entry prices and sufficiently diligencing deals.