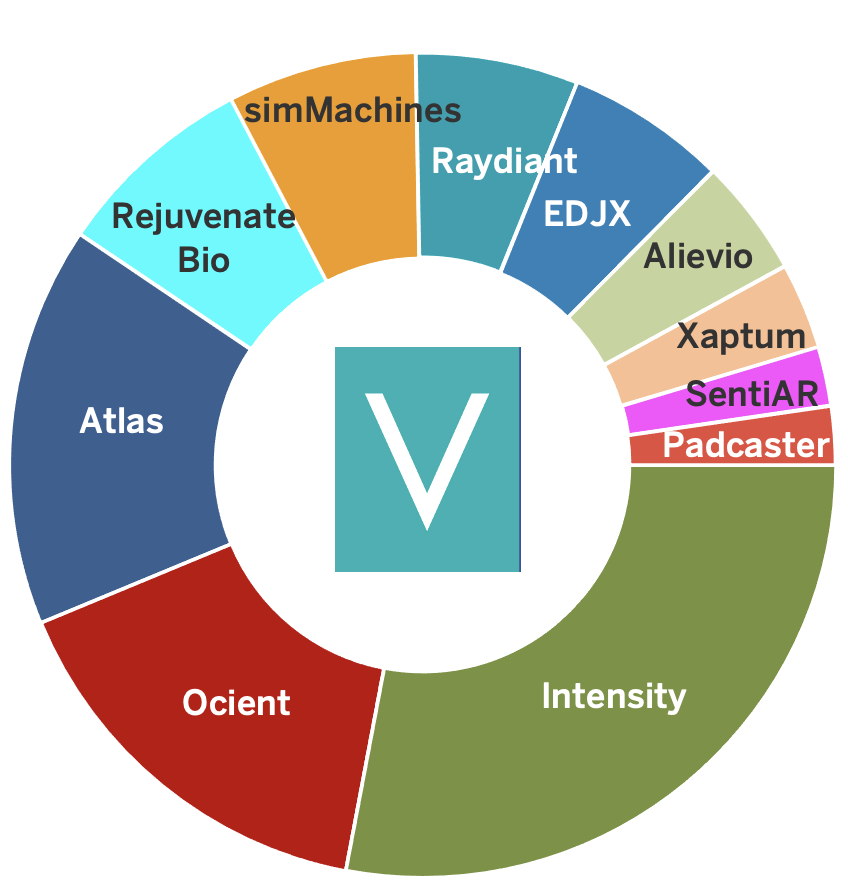

Six years since our first investment in Intensity Therapeutics, VCapital is invested in eleven companies today. Having reached our middle age in “venture capital years,” we are growing increasingly optimistic about our prospects for ultimate maturity.

As we discussed in our recent “Point of View” post, venture capital investment is about batting average (the percentage of investments that deliver positive returns), and even more importantly, hitting some big home runs that return exceptional multiples on invested capital (5, 10, even 20 times invested capital).

VCapital’s focus is on both metrics, achieved by:

- looking far enough into the future to find investment gems others haven’t yet noticed while...

- practicing rigorous screening and due diligence, informed by decades of experience. Cool technology alone is NOT enough; opportunity for a highly-profitable business is essential.

Early stage investment focus can deliver greater returns, but requires investor patience

We aim to get in on the ground floor, when valuations are still low, guided by rigorous screening and due diligence informed by accumulated experience. Wall Street Journal columnist Andy Kessler in his column on April 19 nicely captured our point of view: “My advice is always to invest in the fog. When everyone else is incredulous, look for scale. Squint hard, but don’t make stuff up.”

We DON’T jump on the “whatever-is-hot” bandwagon. We see the recently surging U.S. startup funding (Q1 venture funding at $69 billion and 41% above the previous quarterly record according to industry tracking source Pitchbook) largely as chasing after the next big social media or software platform. We think there will be lots of disappointed investors.

Looking further into the future requires investor patience. Historically, big winners have taken 8-12 years from initial investment to ultimate exit.

“If you can see something that everyone dismisses, and that will get cheaper over a long period of time, maybe decades, buy in cheap and go along for the long ride. Others will eventually overpay.”

Andy Kessler, Wall Street journal

Few early losers; our optimism is well founded

Final outcomes for ventures that are not big winners (perhaps small winners or losers) happen much more quickly. To date, just one of VCapital’s twelve portfolio companies has surrendered and exited: Imagineer Technology Group (the merger partner of the original Synap). While disappointing to us, as is any portfolio company that does not deliver a big positive return, Imagineer did at least return 80 cents for every dollar invested. We remain encouraged that VCapital’s current portfolio companies are still pushing forward.

Upcoming opportunities to invest further in companies continuing to advance

We keep a close eye on portfolio companies’ anticipated additional capital needs. At this point, pending continued milestone achievements, two of VCapital’s portfolio companies may have further capital needs during 2021.

While VCapital’s focus is on early stage investment, we do believe in selectively investing further in companies achieving their key milestones and whose potential remains exceptional. Such companies do usually require additional capital to realize their potential and, as long as the valuation attached to subsequent fundraising remains attractive, it may be wise to increase our investment in order to minimize ownership dilution.

- Alievio is currently conducting a critical monkey study to confirm the effectiveness of its new shunt coating and related product design/engineering modifications. Pending successful results, Alievio will need to raise additional funds during the second half of 2021 in order to move forward with human clinical testing.

- Atlas continues to progress rapidly with the U.S. government (Air Force, NASA, NOAA). The need for additional capital is clear, but how much, how it will be raised, and VCapital’s involvement are being finalized.

Looking further out, continued hoped-for progress may lead to further investment opportunity during 2022 in Intensity Therapeutics, Raydiant Oximetry, SentiAR, and EDJX.

SPACs (Special Purpose Acquisition Companies) are an additional potential exit vehicle

While the big home run investments VCapital seeks require investor patience, those rich returns come only when a venture ultimately exits. Recognizing the uncertainties of public markets and traditional IPOs and even the impact the economy can have on M&A exit opportunities, we are closely monitoring the sudden, dramatic emergence of SPACs (also referred to as “Blank Check” companies) which represent a further potential exit path.

SPACs are companies that go public with no existing assets or business, for the purpose of then merging with a private business, often a venture capital-funded company. They generally have two years following IPO to execute a merger. If a merger is not executed in that timeframe, investors’ shares are redeemed at their purchase price.

The SPAC’s buying power is typically multiplied three- to five-fold when the merger partner has been determined, through a PIPE (Private Investment in Public Equity) investment by an institutional or very substantial individual investor, e.g. a family office, along with sale of shares to traditional retail investors. This enables the venture to become publicly traded and potentially raise large amounts of capital more quickly and efficiently than via the traditional IPO route.

While SPACs have been around for about 20 years, until recently they were viewed warily as IPO wannabes that couldn’t garner investment banker endorsement. Then suddenly in 2019 their acceptance began to grow. In 2019, 59 SPACs launched raising $13 billion. In 2020, 248 launched raising $83 billion. Year-to-date through the end of March, 296 more have launched, raising almost $100 billion.

Just as suddenly, on April 17 The Wall Street Journal reported a dramatic slowdown in SPAC IPOs, from almost five per business day during January-March to just 12 over the previous three weeks. The Journal explained that “critical comments from regulators appear to be scaring off some investors and new offerings.”

The SEC’s concerns seem reasonable. The mad dash to SPACs, many sponsored by show business and sports celebrities with no especially apparent relevant investment expertise and often without clear indication of the nature of merger partners sought, smacks of irrational exuberance.

However, many SPACs make good sense. These generally have been sponsored by well-credentialed investment professionals and/or senior executives, often in pursuit specifically of ventures in strategically targeted categories, some in categories where the sponsors have recognized expertise. Such SPACs may be particularly relevant for prospective merger partners with substantial capital needs.

A number of SPACs have been formed to seek merger partners in the space as well as the aerospace and defense categories that might be interested in Atlas Space Operations. As Atlas’ opportunities with the U.S. government continue to grow rapidly, the company could benefit from such facilitated access to substantial capital. Similarly, several SPACs have been formed to target areas such as networking and cloud and edge computing infrastructure that might speed expansion capital availability to EDJX.

With more than 400 SPACs still seeking merger partners, notwithstanding SEC reservations, exit via SPAC merger is a potential opportunity that will be monitored closely.

Even in middle age, VCapital remains ambitious

Even as we manage the VCapital portfolio to deliver exceptional exit returns to investors in existing portfolio companies, we continue to seek further exceptional ventures worthy of your investment consideration. Our seasoned team continues to look as far into the future as the eye and the imagination can see and then to screen and analyze the best candidates rigorously before investing.

We would welcome your feedback. Talk to us.

Other articles you might like

About Fred Tucker

Leader, Inventor, Investor, Mentor, Friend

Aging is the Mother of All Diseases.

The co-founders of Rejuvenate Bio are developing gene therapies to treat age-related diseases in human and animal health.

Venture Capital Investing Cycles

There are signs of the beginning of a new upswing in the VC investing cycle.